- Business expenses calculator professional#

- Business expenses calculator tv#

- Business expenses calculator download#

- Business expenses calculator free#

If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid. We will not represent you before the IRS or state tax authority or provide legal advice. Audit Support Guarantee – Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2022 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited individual returns filed with TurboTax for the current 2022 tax year and, for individual, non-business returns, for the past two tax years (2021, 2020).

Business expenses calculator free#

(TurboTax Online Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax.

Business expenses calculator tv#

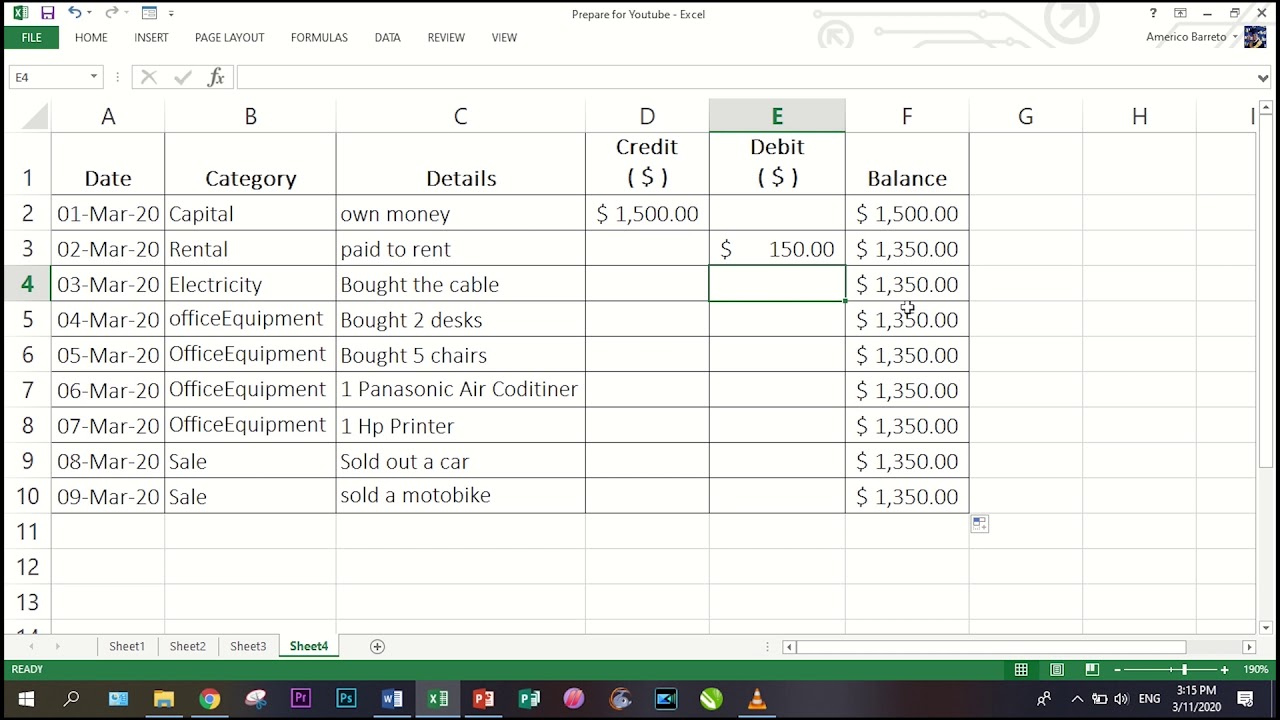

0% of satellite TV subscription unless it’s for business use.10% of power and gas, but you can claim more than this if you can prove you use more for business.Instead, use a logbook to track your business mileage. 0% of vehicle expenses as household costs.0% of furniture and TV only for household use.10% of internet costs, but you can claim more if you can prove you use more for business.

So the owner can claim 10% of expenses not solely for business, eg a power bill. In this example, the house is 100 square metres and the office 10 square metres - 10% of the total area. For the rest, you can claim the proportion of your house that you use for work. You can claim 100% of expenses that are solely for business purposes, eg a business phone line. If you use your home for business - whether you’re a contractor, sole trader, in partnership or own a company - you can claim a portion of household expenses. Work from home? Make sure you claim these expenses Rental property expenses (external link) - Inland Revenue legal fees involved in buying a rental property, as long as the expense is $10,000 or less.depreciation on capital expenses, like whiteware, appliances or heat pumps.

Business expenses calculator professional#

If you own an investment property, expenses you can claim for include: Tool for Business downloads: Vehicle logbook template (external link) - Inland Revenue

Business expenses calculator download#

It's a good idea to use Inland Revenue's vehicle logbook template - download this spreadsheet from the Tool for Business website. work-related mobile phones and phone bills.membership of professional associations.interest on borrowing money for the business.depreciation on items like computers and office furniture.vehicle expenses, transport costs and travel for business purposes.

0 kommentar(er)

0 kommentar(er)